Introduction to CAPS & Financial Planning

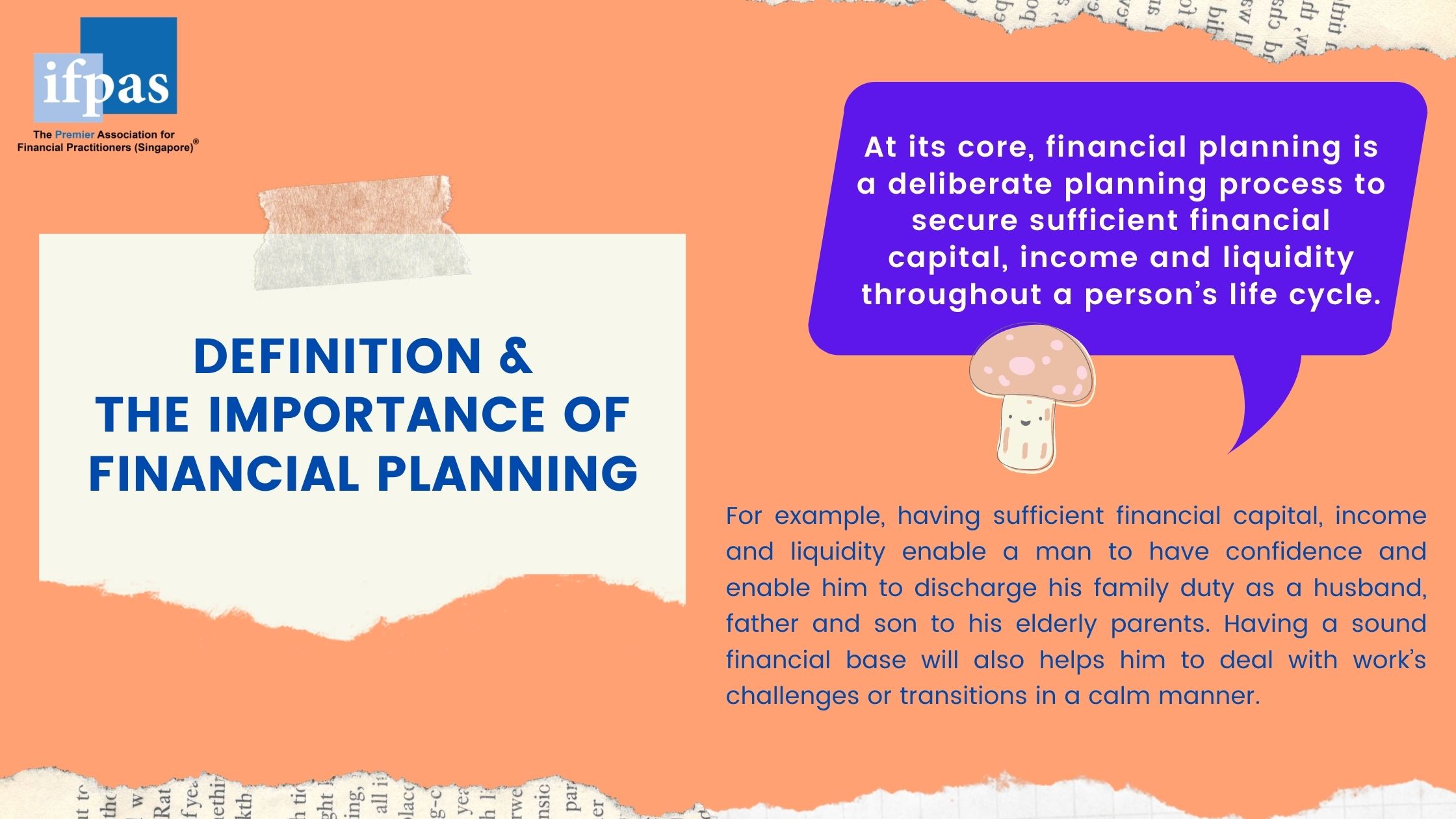

Definition and the Importance of Financial Planning

Contrary to popular belief, financial planning is not about making a person become multi- millionaire. Financial planning is also not about having pride in owning complex and fanciful investment products. Financial planning is about having a sense of responsibility and the moral obligation towards a person’s own life, family and love ones by ensuring sufficient financial capital, income and liquidity throughout a person’s life cycle. This sense of responsibility and moral obligation stem not from law, but out of love and self-respect.

Sound financial well-being is even more important to a woman as it defines her sense of security and confidence as a woman. It gives her confidence to make life and career decisions, enable her to express her love as a daughter to her elderly parents; mother to her children and strengthen her commitment to her husband as a wife if she is married.

Effective Steps to Financial Well-Being

The first step towards deliberate financial planning is to have a right attitude and valuea bout money, second is to follow through a systematic and comprehensive thought process, and third is to set up a system of tracking and taking control over one’sfinances.

Right Attitude & Value about Money

Factor of Consideration No. 1 - The financial adviser representative must be appropriately licensed by MAS (Monetary Authority of Singapore)

1. The firm he is representing – In Singapore, a representative could be from either one of thefollowing:

S/ No |

Types of Company |

Strengths |

Weaknesses |

1. |

Insurance company |

|

1.Product range is limited to single company which can limit the width & depth of the financial plan. |

2. |

Insurance Company owned Financial Advisers Firms |

|

1. Product range is dependent on the number of insurance &investment companies which the firm onboard. |

3. |

Privately owned Financial Adviser Firms |

1. Widest product ranges from various insurance and investment companies. |

Business continuity is highly dependent on shareholders’ preparedness on death, disability, retirement or special situations like bankruptcy, divorce, loss of mental capacity of eachshareholder. |

4 |

Bank |

Strong capital base |

Bank has right of consolidate all the client’s accounts and set-off outstandingdebt owed to thebank. |

B. Factor of Considerations No. 2 – The licensing activities which the representative can do

1. In Singapore, the following are the licensingactivities:

S/No. |

Type of Licensing Activities |

What it means |

1. |

Arranging contracts of insurance in respect of life policies |

Rep can arrange life policies. |

2. |

Advising on investment products (life policies) |

Rep can advise on life policies including investment linked policies. |

3. |

Advising on investment products (units in a collective investment scheme) |

Rep can advise on unit trust, mutual funds and ETFs. |

4. |

Advisingoninvestmentproducts (securities) |

Rep can advise on bonds and securities. |

C. Factor of Consideration No. 3 – Professional Education

It is important to deal with a competent financial adviser rep as you are dealing with money matters. Having or working towards a professional designation is a good sign that this rep is serious in his trade. The followings are some of the good and credible designations to watch out for:

1. Associate Financial Consultant (AFC) – This designation is awarded by Insurance & Financial Practitioners Association of Singapore (ifpas). It is a basic financial planningqualification.

2. Chartered Financial Consultant (ChFC) – This designation is awarded by the Singapore College of Insurance (SCI) under the license of The American College of Financial Services. It is an advance financial counselling and servicesqualification.

3. Fellow Chartered Financial Practitioner (FChFP) – This designation is awarded by the Asia Pacific Financial Services Association (APFinSA). It is an advance and application based financial planning qualification.

4. Chartered Life Under writer(CLU)-This designation is awarded by the Singapore College of Insurance (SCI) under the license of The American College of Financial Services. It is an advance life insurance qualification.

d. Factor of Consideration No. 4 – Member of a Professional Association

1. All professionals will associate themselves with an association and abide by the ethical codes of that association and participate in continuous professional development courses in that association. A financial adviser rep shouldbeamemberofgoodstandingwiththelocalchapterofaprofessional association, for example, the Insurance and Financial Practitioners Association of Singapore(IFPAS)

CONSUMER RIGHTS

Financial planning has to be dealt with carefully, and also openly to a trusted financial adviser rep. The consumer has the following rights:

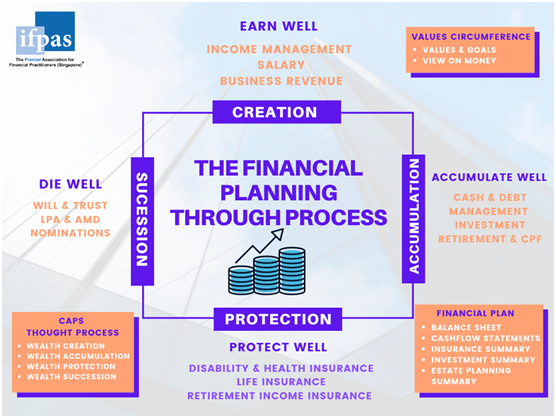

The Financial Planning Though Process

What are the specific outcomes we want to achieve by doing all these? It is to ensure:

a. One has enough capital, income and liquidity when a risk event like death, disability, retirement or special situations happen to him orher.

b. One can make financial planning decision rationally andholistically.

c. One can take on life’s challenges confidently.