| Case Study 1 – Peter, Mary and Elderly Parents |

| Peter is a loving husband to Mary, and a filial (only) son to his elderly parents. Peter and Mary married recently, and Mary is pregnant with their first child. The family is very close, and the mutual relationships are respectful. Peter’s parents sold their HDB flat and help pay for the down-payment ($100,000) of Peter and Mary’s matrimonial home. As a gesture, Peter and Mary invited Peter’s parents to move in and stay with them. This is a happy family, and Peter’s parents were eagerly waiting their first grandchild to be born. Unfortunately, Peter dies in a road accident. The family is devastated. Peter leaves behind no valid will. |

| After the funeral, Mary and Peter’s elderly parents sat down to administer Peter’s estate (i.e. assets left behind). Peter’s estate is as follows: | |||

| Assets | Market Value | Ownership Structure | |

| Immovable | Movable | ||

| Property | $800,000 | Joint Tenancy(wife) | |

| CPF | $ 80,000 | No nomination | |

| Life Insurance | $100,000 | No nomination | |

| Employee Benefit | $ 50,000 | Estate | |

| Cash @ Bank | $ 50,000 | Estate | |

| Investments | $ 20,000 | Estate | |

| Total | $800,000 | $300,000 | |

| Peter’s liability (which must be settled before the net estate can be distributed) is as follows: | ||

| Liabilities | Outstanding Value | Liable Parties |

| Mortgage Loan | $600,000 | Wife is Joint & Severally Liable |

| Total | $600,000 | |

| As Peter dies without a will, no nominations on CPF and life insurance. Based on the Intestate Succession Act in Singapore, the stakeholders of Peter’s estate are as follows: | ||

| Mary (wife) | Child (assume born alive subsequently) | Parents |

| Immovable Assets $800,000 | Immovable Assets $0 | Immovable Assets $0 |

| Movable Assets $150,000 | Movable Assets $150,000 | Immovable Assets $0 |

| Estate Liabilities | ||

| Jointly & Severally Liable $600,000 | $0 | $0 |

| Outcome of Peter’s Estate | |

|

From above example, it clearly demonstrated that Peter’s death creates an outcome which is not acceptable to Peter

- Wife is short of liquid cash to pay the bank,

- Parents inherit nothing and could potentially be invited out of the house as Mary becomes its sole owner.

This outcome creates problems to the family, which can tantamount to breaking up of family relationships of the surviving family members.

The “What” of Wealth Succession

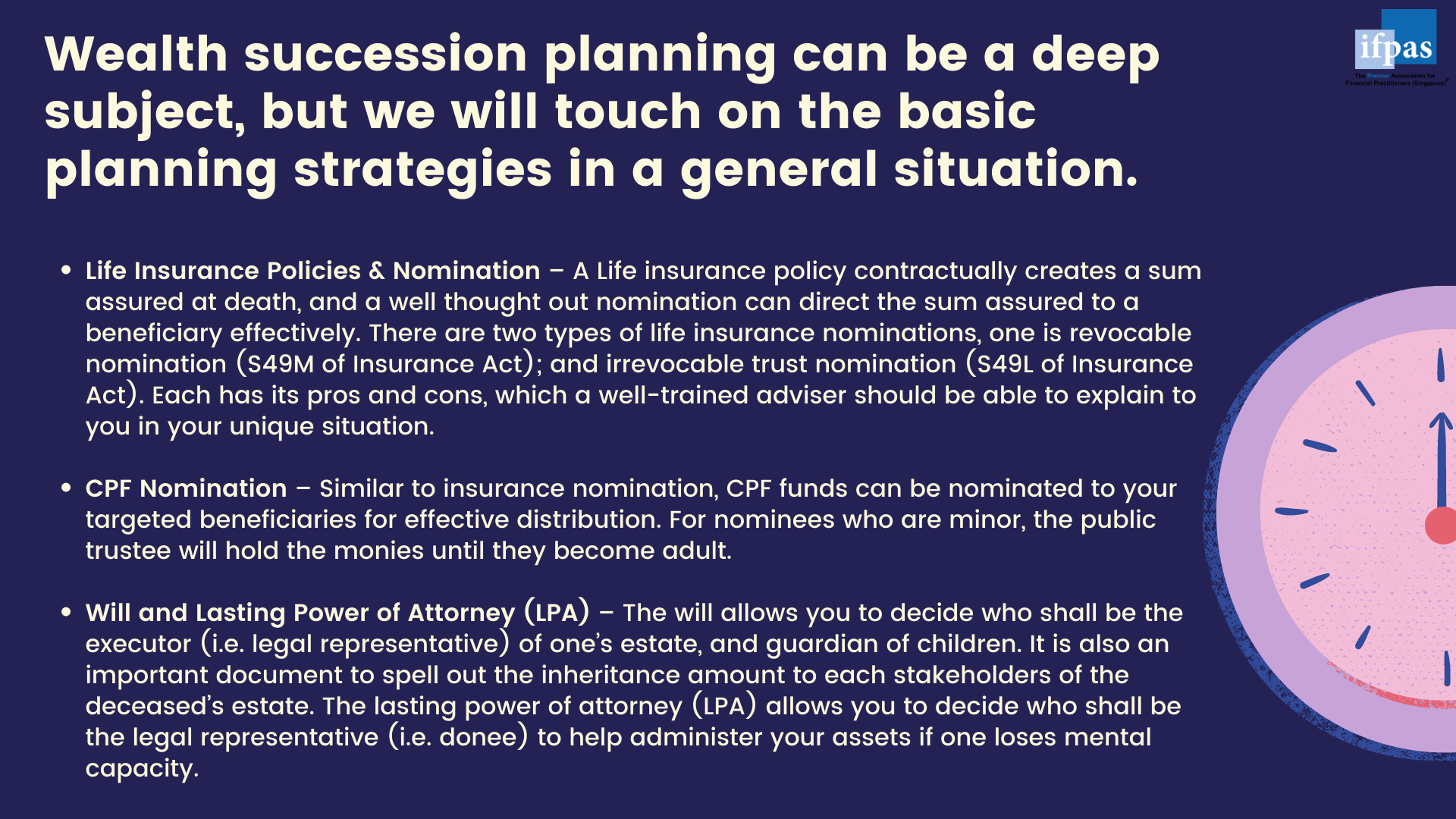

The “How” of Wealth Succession

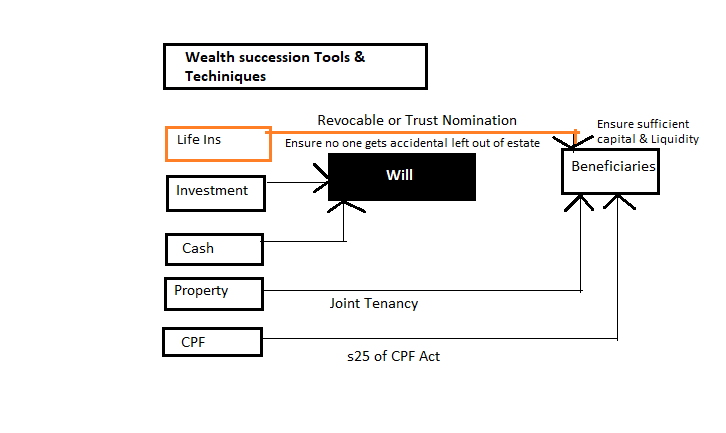

The following diagram shows the general wealth succession strategies and reasoning as described above:

Financial Planning Tools – Estate Planning Summary

Just like the rest of the planning processes, it is important to organise and keep track of your wealth succession plan into an estate planning summary

Table 1: Estate Planning Summary

| Estate Planning Documents | Remarks (Name & Contact Details of Advisers) |

1. Insurance Policies,

|

|

2. CPF

|

|

3. Will

|

|

| 4. LPA • Donee |

References

The CAPS Wealth Planning Framework is based on the following references:

- The Methodology of Financial Planning from the Chartered Financial Consultant/Singapore (ChFC/S) Course.

- The following statutes:

- Insurance Act (Cap. 142)

- Securities & Futures Act (Cap. 289)

- Financial Advisers Act (Cap. 110)

- Intestate Succession Act (Cap. 146)

- Central Provident Fund Act (Cap. 36)

- Wills Act (Cap. 352)

- Mental Capacity Act (Cap. 177A)

- Bankruptcy Act (Cap. 20)

- Singapore Deposit Insurance Corporation Limited (SDIC)

- Financial Industry Disputes Resolution (FIDRec)

- Insurance and Financial Practitioners Association of Singapore (ifpas)’s Code of Ethics.