IFPAS, a not for profit organization, started as the Singapore Insurance Agents Association (SIAA) and officially registered with the Registry of Societies on 18 March 1969.

On 25 October 1978, the Association changed its name to the Life Underwriters Association of Singapore (LUA Singapore) to represent all life insurance practitioners in Singapore.

LUA holds 1st Sales Congress on Nov 15 – 17 with 299 delegates. Lawrence Wilkinson from the United States and Bod Chambers from Australia were main speakers.

LUA raises $40,000 for National Kidney Foundation, its first community service effort.

LUA’s 10th anniversary, with membership figures standing at 1,700.

LUA membership numbers cross 2,500 mark.

LUA organises 1st Asia-Pacific Life Insurance Council. Holds Asia-Pacific Congress with 1,500 agents from the region.

LUA launches bilingual newsletter for members.

LUA adopts Life Underwriters Training Council Programme from the US, incorporating Personal and Business Insurance courses, as well as modules in Professional Growth and Fundamentals of Financial Services.

LUA hosts first Asia-Pacific Agency Managers Congress, a three-day event for 800 managers from Singapore, Malaysia, Hong Kong, Indonesia, Thailand, United States, the Philippines, Japan and Australia.

LUA hits 7,000 member mark.

LUA raises $500,000 for Community Chest.

LUA launches Professional Ethics Programme.

LUA launches Bachelor of Business degree in collaboration with RMIT University, Australia and Singapore Institute of Management.

LUA newsletter re-named Coverage, with new features including lifestyle articles and classified advertisements.

LUA’s 20th anniversary is celebrated with the launch of the Life Insurance Practitioner of the Year award.

1st Life Insurance Specialist Symposium: Emerging distribution Channels in the 21st Century

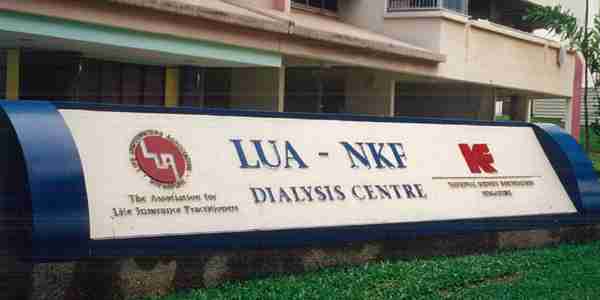

LUA and the National Kidney Foundation officially open a dialysis centre on Jan 30.

LUA introduces Associate Financial Consultant designation.

LUA re-locates to a five-storey building in Hong Kong Street.

LUA launches MBA Financial Services Certification.

On 29 January 2003, it changed its name to the current Insurance and Financial Practitioners Association of Singapore (IFPAS) to reflect its representation of not just members from insurance films but all members who provide financial services.

IFPAS launches Fellow Chartered Financial Practitioner (FChFP) designation.

IFPAS is appointed by Singapore College of Insurance (SCI) to organise and market Chartered Financial Consultant (ChFC) programme

IFPAS “Strategical Technical Advance Response” (STAR) team, a dedicated ‘think tank’ designed to engage FAIR, is formed in July.

First IFPAS Day marked on Oct 30, at Hersing Hub in Toa Payoh. Features appreciation ceremony for past presidents, company CEOs and FinCARE beneficiaries.

IFPAS launches the Education Roadmap on 27th September, which was graced by the then-President of the Life Insurance Association (LIA), Ms Annette King.

IFPAS Alliance embarked on a community engagement initiative service – Financial Counselling, Aid and Resilience Education (FinCARE®) on 2nd October, which was graced by the then-Assistant Managing Director (Capital Markets), MAS, Mr Lee Chuan Teck. It was also an opportunity to launch the SEED Money Programme. At the same time, IFPAS was able to raise a fund worth $100,000 to the needy children under The Straits Times School Pocket Money Fund (SPMF), through the generous hearts of our fellow practitioners and various insurance industry companies. The cheque was presented to SPMF Chairman Han Fook Kwang.

Minister Chan Chun Sing proposed on the involvement of IFPAS in the new government health scheme, MediShield Life on 4th August.

In October, IFPAS Alliance STAR Team welcomed a new addition to the group, Frank Ng of Great Eastern Life.

IFPAS, in collaboration with MOH, PA and PMO, piloted the 1-to-1 pro bono MediShield Life Consultation at Buona Vista CC on 6th July.

IFPAS and NTUC-SIEU signed a collaboration agreement to reach out to and engage the industry practitioners on 1st October.

IFPAS officially launched the 1-to-1 pro bono MediShield Life Consultation islandwide on 2nd November and was graced by Minister Chan Chun Sing.

It was a first for IFPAS and SCI to jointly host the ChFC®/S Graduation Ceremony held at Suntec Tower 2 on 19th November.

The Institute of Banking and Finance Singapore (IBF) launched a new set of competency standards for financial planning on 22nd April. IFPAS played a key role in developing the national accreditation standards through a tripartite collaboration with IBF and SCI.

IFPAS successfully completed the 1-to-1 pro bono MediShield Life Consultation, which benefitted over 8,500 residents across Singapore.

n January of this year, IFPAS has been engaged by Ministry of Health (MOH) to participate in focus group discussion (FGD) sessions to review on proposed enhancements on ElderShield.

As part of IFPAS’ efforts to drive professional & moral standards of the industry practitioners, IFPAS has organised the inaugural IFPAS All-Star Awards on 18 January 2018. This event aspires to recognise deserving financial practitioners, who have excelled professionally and in various social causes. The event was held at Carlton Hotel Singapore and we are honoured to have the presence of Mr. Tan Chuan-Jin, Speaker of the Parliament, as our Guest of Honour.

As part of our efforts to drive unity and camaraderie among the industry practitioners, IFPAS was pleased to have held its inaugural IFPAS RUN on 17 March 2019, 7:00am at Marina Barrage. The event was graced by Guest-of-Honour Minister Chan Chun Sing and saw a total of 3,000 IFPAS members and their families and friends. Our aim was to bring the various financial institutions together under the umbrella of IFPAS to signify unity among the financial practitioners, as we geared towards a common goal and that raised professionalism and excellence in the business. Part and parcel of the profession is creating an impact to the community, especially the underprivileged and target community groups. Financial practitioners are more than salespersons, they are individuals whose expertise and knowledge are valuable for the benefit of society at large, which promotes association social responsibility.

IFPAS, a not for profit organization, started as the Singapore Insurance Agents Association (SIAA) and officially registered with the Registry of Societies on 18 March 1969.

On 25 October 1978, the Association changed its name to the Life Underwriters Association of Singapore (LUA Singapore) to represent all life insurance practitioners in Singapore.

LUA holds 1st Sales Congress on Nov 15 – 17 with 299 delegates. Lawrence Wilkinson from the United States and Bod Chambers from Australia were main speakers.

LUA raises $40,000 for National Kidney Foundation, its first community service effort.

LUA’s 10th anniversary, with membership figures standing at 1,700.

LUA membership numbers cross 2,500 mark.

LUA organises 1st Asia-Pacific Life Insurance Council. Holds Asia-Pacific Congress with 1,500 agents from the region.

LUA launches bilingual newsletter for members.

LUA adopts Life Underwriters Training Council Programme from the US, incorporating Personal and Business Insurance courses, as well as modules in Professional Growth and Fundamentals of Financial Services.

LUA hosts first Asia-Pacific Agency Managers Congress, a three-day event for 800 managers from Singapore, Malaysia, Hong Kong, Indonesia, Thailand, United States, the Philippines, Japan and Australia.

LUA hits 7,000 member mark.

LUA raises $500,000 for Community Chest.

LUA launches Professional Ethics Programme.

LUA launches Bachelor of Business degree in collaboration with RMIT University, Australia and Singapore Institute of Management.

LUA newsletter re-named Coverage, with new features including lifestyle articles and classified advertisements.

LUA’s 20th anniversary is celebrated with the launch of the Life Insurance Practitioner of the Year award.

1st Life Insurance Specialist Symposium: Emerging distribution Channels in the 21st Century

LUA and the National Kidney Foundation officially open a dialysis centre on Jan 30.

LUA introduces Associate Financial Consultant designation.

LUA re-locates to a five-storey building in Hong Kong Street.

LUA launches MBA Financial Services Certification.

On 29 January 2003, it changed its name to the current Insurance and Financial Practitioners Association of Singapore (IFPAS) to reflect its representation of not just members from insurance films but all members who provide financial services.

IFPAS launches Fellow Chartered Financial Practitioner (FChFP) designation.

IFPAS is appointed by Singapore College of Insurance (SCI) to organise and market Chartered Financial Consultant (ChFC) programme

IFPAS “Strategical Technical Advance Response” (STAR) team, a dedicated ‘think tank’ designed to engage FAIR, is formed in July.

First IFPAS Day marked on Oct 30, at Hersing Hub in Toa Payoh. Features appreciation ceremony for past presidents, company CEOs and FinCARE beneficiaries.

IFPAS launches the Education Roadmap on 27th September, which was graced by the then-President of the Life Insurance Association (LIA), Ms Annette King.

IFPAS Alliance embarked on a community engagement initiative service – Financial Counselling, Aid and Resilience Education (FinCARE®) on 2nd October, which was graced by the then-Assistant Managing Director (Capital Markets), MAS, Mr Lee Chuan Teck. It was also an opportunity to launch the SEED Money Programme. At the same time, IFPAS was able to raise a fund worth $100,000 to the needy children under The Straits Times School Pocket Money Fund (SPMF), through the generous hearts of our fellow practitioners and various insurance industry companies. The cheque was presented to SPMF Chairman Han Fook Kwang.

Minister Chan Chun Sing proposed on the involvement of IFPAS in the new government health scheme, MediShield Life on 4th August.

In October, IFPAS Alliance STAR Team welcomed a new addition to the group, Frank Ng of Great Eastern Life.

IFPAS, in collaboration with MOH, PA and PMO, piloted the 1-to-1 pro bono MediShield Life Consultation at Buona Vista CC on 6th July.

IFPAS and NTUC-SIEU signed a collaboration agreement to reach out to and engage the industry practitioners on 1st October.

IFPAS officially launched the 1-to-1 pro bono MediShield Life Consultation islandwide on 2nd November and was graced by Minister Chan Chun Sing.

It was a first for IFPAS and SCI to jointly host the ChFC®/S Graduation Ceremony held at Suntec Tower 2 on 19th November.

The Institute of Banking and Finance Singapore (IBF) launched a new set of competency standards for financial planning on 22nd April. IFPAS played a key role in developing the national accreditation standards through a tripartite collaboration with IBF and SCI.

IFPAS successfully completed the 1-to-1 pro bono MediShield Life Consultation, which benefitted over 8,500 residents across Singapore.

n January of this year, IFPAS has been engaged by Ministry of Health (MOH) to participate in focus group discussion (FGD) sessions to review on proposed enhancements on ElderShield.

As part of IFPAS’ efforts to drive professional & moral standards of the industry practitioners, IFPAS has organised the inaugural IFPAS All-Star Awards on 18 January 2018. This event aspires to recognise deserving financial practitioners, who have excelled professionally and in various social causes. The event was held at Carlton Hotel Singapore and we are honoured to have the presence of Mr. Tan Chuan-Jin, Speaker of the Parliament, as our Guest of Honour.

As part of our efforts to drive unity and camaraderie among the industry practitioners, IFPAS was pleased to have held its inaugural IFPAS RUN on 17 March 2019, 7:00am at Marina Barrage. The event was graced by Guest-of-Honour Minister Chan Chun Sing and saw a total of 3,000 IFPAS members and their families and friends. Our aim was to bring the various financial institutions together under the umbrella of IFPAS to signify unity among the financial practitioners, as we geared towards a common goal and that raised professionalism and excellence in the business. Part and parcel of the profession is creating an impact to the community, especially the underprivileged and target community groups. Financial practitioners are more than salespersons, they are individuals whose expertise and knowledge are valuable for the benefit of society at large, which promotes association social responsibility.

In 2010, the MAS introduced the Span of Control directive, limiting each manager to 15 direct agents and group managers to 10 managers. This move is against the spirit of free enterprise.

Following the STAR team engagement, Mr. Lee Chuan Teck, Assistant Managing Director of the Capital Markets Group at MAS, agreed to look into this matter after the BSC was finalised. After the BSC had been finalised, the MASeased the Span of Control requirement and the discretion was left to the respective company CEOs.

The STAR team was formed in response to the sudden launch of The Financial Advisory Industry Review (FAIR) by Mr Ravi Menon, Managing Director of the Monetary Authority of Singapore (MAS), during the 50th Anniversary dinner of Life Insurance Association (LIA) Singapore.

The STAR team represents the alliance of IFPAS, FSMA and the guilds of the various insurance companies.

The FAIR aims to enhance the standards and professionalism of the FA industry and improve efficiency in the distribution of life insurance and investment products in Singapore. The FAIR Panel focused on five key thrusts:

(a) raising the competence of FA representatives;

(b) raising the quality of FA firms;

(c) making financial advising a dedicated service;

(d) lowering distribution costs; and

(e) promoting a culture of fair dealing.

Over the following years, the team engaged MAS and the stakeholders tirelessly to overcome the threats.

After numerous meetings, the MAS agreed to retain the commission remuneration structure and the three-tier structure instead of the proposed fee-based remuneration structure and two-tier structure.

In line with the commission remuneration structure, the MAS proposed a deferred payment system but the STAR team found that this will result in a reduction of total compensation. Thus, STAR team counter-proposed to maintain the existing maximum First Year Commission (FYC) of 50%, to which the MAS reverted with 55%.

The purpose of BSC is to promote good behaviour and to encourage FA representatives to provide quality advice and suitable recommendations.

The four (4) KPIs in this framework are:

(a) understanding customers’ needs;

(b) suitability of recommendations;

(c) adequacy of information disclosure; and

(d) standards of professionalism and ethical conduct.

Those found with infractions will be penalised financially. The STAR team achieved a major victory by convincing the MAS to adopt clawing back of commissions instead of withholding the commissions.

The STAR team upheld the principle that everyone is “innocent until proven guilty.”

MAS FAIR panel proposed that consumers can purchase directly from insurance companies, without financial advice and without commission charged. (direct purchase products).

The STAR team managed to narrow the products to term life insurance products with total permanent disability (TPD) and traditional whole life insurance products with TPD, with an option to cover critical illnesses.

The BPD gives the consumer a choice of a cheaper alternative to the whole life or endowment plan, by compelling insurers to display the DPI in the business illustration.

It is not fair anddefinitely controversial to compare products that are sold with advice with those that are bought without advice, for agents to show the DPI that they are not responsible for.

The inclusion of Direct Purchase Insurance (DPI) was a total surprise to the STAR team and they were strongly against it.

The STAR team had many fruitless meetings with the MAS for DPI to be removed. This matter was then raised to Deputy Prime MinisterTharman Shanmugaratnam, who was convinced and DPI was eventually removed.

In 2010, the MAS introduced the Span of Control directive, limiting each manager to 15 direct agents and group managers to 10 managers. This move is against the spirit of free enterprise.

Following the STAR team engagement, Mr. Lee Chuan Teck, Assistant Managing Director of the Capital Markets Group at MAS, agreed to look into this matter after the BSC was finalised. After the BSC had been finalised, the MASeased the Span of Control requirement and the discretion was left to the respective company CEOs.

The STAR team was formed in response to the sudden launch of The Financial Advisory Industry Review (FAIR) by Mr Ravi Menon, Managing Director of the Monetary Authority of Singapore (MAS), during the 50th Anniversary dinner of Life Insurance Association (LIA) Singapore.

The STAR team represents the alliance of IFPAS, FSMA and the guilds of the various insurance companies.

The FAIR aims to enhance the standards and professionalism of the FA industry and improve efficiency in the distribution of life insurance and investment products in Singapore. The FAIR Panel focused on five key thrusts:

(a) raising the competence of FA representatives;

(b) raising the quality of FA firms;

(c) making financial advising a dedicated service;

(d) lowering distribution costs; and

(e) promoting a culture of fair dealing.

Over the following years, the team engaged MAS and the stakeholders tirelessly to overcome the threats.

After numerous meetings, the MAS agreed to retain the commission remuneration structure and the three-tier structure instead of the proposed fee-based remuneration structure and two-tier structure.

In line with the commission remuneration structure, the MAS proposed a deferred payment system but the STAR team found that this will result in a reduction of total compensation. Thus, STAR team counter-proposed to maintain the existing maximum First Year Commission (FYC) of 50%, to which the MAS reverted with 55%.

The purpose of BSC is to promote good behaviour and to encourage FA representatives to provide quality advice and suitable recommendations.

The four (4) KPIs in this framework are:

(a) understanding customers’ needs;

(b) suitability of recommendations;

(c) adequacy of information disclosure; and

(d) standards of professionalism and ethical conduct.

Those found with infractions will be penalised financially. The STAR team achieved a major victory by convincing the MAS to adopt clawing back of commissions instead of withholding the commissions.

The STAR team upheld the principle that everyone is “innocent until proven guilty.”

MAS FAIR panel proposed that consumers can purchase directly from insurance companies, without financial advice and without commission charged. (direct purchase products).

The STAR team managed to narrow the products to term life insurance products with total permanent disability (TPD) and traditional whole life insurance products with TPD, with an option to cover critical illnesses.

The BPD gives the consumer a choice of a cheaper alternative to the whole life or endowment plan, by compelling insurers to display the DPI in the business illustration.

It is not fair anddefinitely controversial to compare products that are sold with advice with those that are bought without advice, for agents to show the DPI that they are not responsible for.

The inclusion of Direct Purchase Insurance (DPI) was a total surprise to the STAR team and they were strongly against it.

The STAR team had many fruitless meetings with the MAS for DPI to be removed. This matter was then raised to Deputy Prime MinisterTharman Shanmugaratnam, who was convinced and DPI was eventually removed.

Copyright © 2024 Insurance and Financial Practitioners Association of Singapore. All Rights Reserved.